Why annual report is important?

Annual reports provide information on the company’s mission and history and summarize the company’s achievements in the past year. … The chief purpose of the achievements section is to make shareholders and stakeholders feel good about their investments or participation in your company.

Who prepares annual report?

You will want to include a letter from the Owner/President/CEO, financial reports, an auditor’s report, reports from management and a corporate message. One staff member should serve as the point person for editing and putting together the final report, but the initial writing can be a team project.

What makes a good annual report?

Your Annual Report should be professional, polished, and proof-read. An Annual Report serves as a transparent accounting of what you’ve accomplished over the past year, but also as a marketing piece. A great Annual Report can attract new donors, renewed donations from your base, and non-monetary support.

10 important things to analyses while reading an annual report are as follows:

1) Vision and mission statements of the company

In this section, you will get to read vision and mission statement, values and goals of the company. These statements are general in nature. Take a look at vision and mission statements of Infosys:

Vision: “We will be a globally respected corporation.”

Mission: “Strategic Partnerships for Building Tomorrow’s Enterprise.”

Some companies also set a vision like “To touch revenues of Rs 5000 crore in 5 years.”

Value of the information: Low to medium (since these statements are generic in nature)

2) Corporate information

In this section, you will get details of directors, bankers, auditors and registered and corporate office. Key things to look is designation of each board members, in case auditors are reputed they provide additional comfort to the company you are investing.

Value of the information: Medium

3) Products overview and financial highlights in last 5 to 10 years

Get details of products being manufactured by a company, segment wise performance in last two years, key raw materials consumed, etc. Some companies publish financial highlights of 5 to 10 years in annual reports. You will get to analyse trend of revenue, earnings before interest, tax, depreciation and amortization (EBITDA), profit after tax (PAT/Net income / loss) from income (profit and loss) statement and also get a glimpse on shareholders equity, assets, debtors, liability and total debt from balance sheet over the years. Important ratios are also presented in charts over 5 to 7 years time line.

Value of the information: Medium

4) Director’s report

This section provides brief summary on financials, explanation of the financial results, key developments in the company. Key things to look in here are operational parameters of the company such as capacity additions, capex plan / executed during the year, order book as on financial year end, average length of stay, occupancy rates, average revenue per occupied bed, average revenue per user, etc. Terms used to discuss operation of the company varies depending on sectors so get some knowledge about industry terms or use glossary to get better insights. Read the past 3 to 5 years director report to see whether management has achieved the set revenue target over the years, whether strategies adopted over the years were favorable for company and did management able to perform during roller coaster ride of an economy. Also, look at the tone of the director report while reading annual report. Ideally, it sounds positive in good years and negative in bad years of the company performance.

Value of the information: High

5) Management discussion and analysis (MDA)

This section provides information on trends in the industry, SWOT analysis of the company, insights on key line items of financial statements and risk factors/concerns affecting the company performance. You will get relevant information to understand the industry while reading this section. It’s appreciated to read at least 3-5 years of MDA to understand trends of the company in different economy scenario.

Value of the information: High

6) Report on Corporate governance

This section gives insight on corporate governance followed by a company, composition of board of directors, brief background information on directors and independent directors of the company, attendance of directors in board meetings and annual general meetings, remuneration of directors, re-appointment of directors after completing the term, composition of sub-committees, etc. Key things to look here is composition of board of directors, sub committees and attendance records of directors during meetings, relate remuneration paid to directors with profits earned by the company. Analyse whether profile of independent directors match with the requirement of company as per sector of a company.

Value of the information: High

7) Information on shares of the company

This section provides information on historical performance of share price, share holding pattern of the company, pledging of shares by promoters during the year, split of shares, bonus shares distributed, etc.

Value of the information: Medium

8) Auditors report

This section gives information on comments by auditors on the financials of the company. You look out who are the auditors for the company and any qualifications by the auditors on internal processes. The information on change in accounting policy if any will be highlighted in this section.

Value of the information: High

9) Financial statements

This section provides detailed information on profit and loss accounts (income statement), balance sheet as on year end, cash flow statement and schedules of the financials for two years. Analyzing numbers from this section help us to check financial health of the company. We will explain in other article key things to look in financial statements for fundamental analysis of a company.

Value of the information: High

10) Notes to accounts

In this section you will get information on accounting policy followed by a company, depreciation method, forex losses / gains, segmental reporting, inventories, liabilities, leases, etc. It will be helpful if you read notes to account section of last 3 to 5 years. This will help to get information on any change in accounting year or accounting policy which can inflate revenues or profits of the company, trend in segmental revenues / profitability, contingent liabilities over the years, related party transactions, etc.

Value of the information: High

You may find reading an annual report is tedious exercise for the first time. However, it’s an advice to analyse at least 2 to 3 years past annual reports of a company to understand in and out about operations of the company, financials and management’s view/stand in various economic trends. A corporate and analyst presentation available on company website are useful sources of information with reading an annual report then take a decision of buy, sell or hold of stocks with your understanding.

How to write an annual report

Many people come to this site looking for advice on how to write an annual report. This post is for you. We’ve assumed that you’re writing it for a UK public company but most of the principles here apply to any kind of organisation.

You should have started weeks ago…

1. Work out your timetable

It’s a basic point but you need to give yourself enough time to get the report written and published. Don’t underestimate this.

Writing an annual report can easily take eight weeks or more, bearing in mind that you need to gather the information, produce a draft, get it reviewed (often several times), then signed off by management and (probably) the board. Then you’ll need to allow time for artworking, proofreading, printing and mailing.

There may be a specific date you need to issue the report by (for example, in time for your company’s annual general meeting). If there is, start with that date and work backwards. You’ll need to factor in other immovable deadlines, such as board meetings where your draft will be reviewed, or your full year results announcement, when your auditors will also want to sign off your annual report.

If there isn’t a fixed date, then set yourself a realistic point when you want it done. Give yourself enough time but don’t let it drag or it’ll become a burden and your corporate memory of the year will fade.

2. Start to think about the content

Good planning is essential if you’re going to make the writing stage as painless as possible. Think about what you want to say before you start writing. There are three main aspects to this:

- what you want to say

- what you have to say, and

- what others in your industry are saying.

a) What you want to say – meeting your audience’s needs

All good business writing is created with the needs of its audience in mind. Annual reports are no exception.

In the UK, the strategic report regulations are quite clear that the report is for investors, so if the regulations apply to your company, that’s who you’re writing for. Other people will read it too – your employees, customers, suppliers, lenders, NGOs, regulators and the media – but your investors’ needs are paramount.

If you’re not bound by the regulations, then you might have a different audience in mind – your customers or business partners, for example.

Whoever you’re writing for, you need to understand what they want from you. Put yourself in their shoes. If you were looking to invest in a company, what would you want to know about it?

b) What you have to say – understanding the regulatory requirements

Good reports reflect your desire to communicate effectively but you can’t ignore the reporting rules. For a UK listed company, these include the strategic report regulations and the corporate governance code.

Whatever rules apply to your organisation, make sure you understand them. They tell you the minimum content you have to produce. However, if you’re interested in a report that’s anything like good practice, you’ll need to go further. The Financial Reporting Council’s guidance on strategic reports introduces a number of concepts that go well beyond the regulations. The guidance isn’t perfect but it’s essential reading if you’re required to produce a strategic report and helpful even if you’re not.

c) What others are saying – peers and best practice

Have a look at what your competitors are saying in their reports. You can draw inspiration from the things they do well and find opportunities to stand out. If your peers aren’t clearly articulating their strategies, for example, you can seize the high ground with a compelling explanation of what you’re looking to achieve.

Similarly, it’s worth studying examples of best practice reporting. Some of the large UK design agencies produce yearly round ups and there are numerous awards that point you towards who’s doing well.

The point of these exercises is not to slavishly copy other reports. Find what you can use and tailor it to your situation.

3. Determine your key messages

It’s highly likely that your senior management will have key points they want your audience to understand about the business, its strategy, its performance and its prospects. For example, was it a good year or merely an average one? Do you want to be cautious or optimistic about the future? What do you want to say about the level of competition? Your success with new products? Your sustainability strategy?

Every company will have its own set of hot topics. Understanding yours at the outset will save you a lot of pain and rewriting later on.

4. Agree your writing style

If you’re lucky, your organisation will already have a clearly defined tone of voice. If not, you’ll need to decide how you want to present your organisation in writing. This needs to reflect your brand and culture, so don’t fall into the trap of thinking that a formal document like the annual report has to have a formal writing style. If your organisation prides itself on being straightforward and easy to deal with, then a simple conversational style may fit best.

Whatever route you go down, get your senior management to agree to it before you start. If necessary, write an example paragraph or two in a number of different ways, so they can get a good feel for what you mean. Otherwise you may have to rewrite your report when they recoil at the way you’ve done it.

5. Decide on your structure

The work you’ve done under point 2 should have given you clear thoughts about structuring your report. If you’re a UK-listed company, you’re going to have:

- a strategic report

- a corporate governance section, including the directors’ report, the corporate governance report and the remuneration report, and

- the financial statements.

The content of the governance sections is driven by required disclosures (for example those in the corporate governance code and the regulations covering remuneration reporting), so you’ll be able to determine the content of those relatively easily.

The strategic report, though, has much more flexibility. There’s no definitively ‘correct’ way of structuring a strategic report and the FRC has deliberately avoided giving an example, because it wants companies to have the freedom to tell their story. However, most good strategic reports include the following:

Strategic report

- Business overview

- Markets

- Business model

- Strategy

- Highlights of the year

- Chairman’s statement

- Chief executive’s statement

- Key performance indicators

- Principal risks and uncertainties

- Operating review

- Financial review

- Sustainability

- Optional – case studies to illustrate particular products or a theme, such as the importance of your people

The thought you put in now will save you time and angst later…

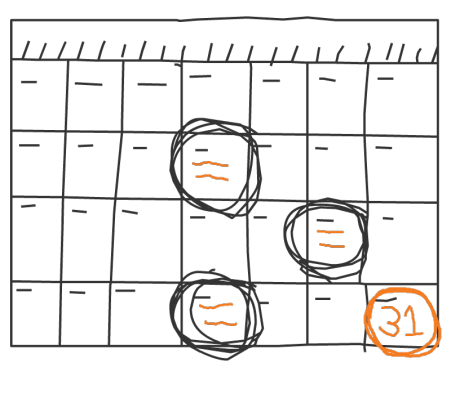

6. Work out the likely content for each page

You’ve thought about who you’re writing for and worked out your structure. Now you can rough out the main areas of content for each section. So in the markets section, for example, you might cover:

- Who your customers are

- The size of the market and its growth rate

- What’s driving your market (for example, social trends, new product development, regulation)

- The international spread of your market

- Who your competitors are and whether competition is increasing or decreasing

Once you’ve roughed out the content for each section, you’ll be in a much better position to efficiently gather the information you’ll need to write it. This process also allows your design agency to start thinking about page designs and word counts, which are key for when you start to write.

7. Work out who your contributors will be

In other words, who in your company has the information you need to create the content? This is likely to include your:

- Chairman

- Chief executive

- Finance director

- Divisional / operational heads

- Company secretary

- HR director

- Head of sustainability

You may also need to talk to procurement and customer service.

Make sure all your contributors are aware that you need their input and that they’ll have to review drafts and sign off the content.

8. Decide how you’re going to get the information you need

Your contributors have the information. You need to get it out of them. To do this, you can:

Interview them

Don’t wing it. Prepare your questions in advance, making sure they cover all the areas on which you need input. It can be helpful to send the questions to your interviewees, so they can prepare.

Get long enough appointments to go through every question. Record your interviews, so you can listen back later and be absolutely clear on what you were told. Unless you can do shorthand, it’s almost impossible to write everything down when someone is talking at normal speed.

Make sure your interviewees give you a considered answer to every question. Don’t be afraid to ask them to clarify their points or to go into more detail. If they give you too much information, repeat the key points you’ve taken from what they’ve said, and ask them to confirm that it’s right.

Send them questionnaires to complete

Instead of interviewing your contributors, you can ask them to give you written answers to your questions. This can work well but you’ll often get variable amounts and quality of information. Some will supply too much, while others give you almost nothing. Often you’ll need a follow-up call or meeting.

Ask them to draft their sections

This can save you a lot of time. Ask your contributors to give you the content directly, either as fully formed copy or as bullet points you can work into proper text. If you want them to write copy, you’ll need to give them careful guidance on content and style.

This approach is often effective but it can be very difficult for a first report, when your contributors will be less clear of what’s expected. It can also be hard to conform all the styles afterwards, so you end up with report that looks like it’s been written by a committee.

9. Start writing

If your contributors aren’t writing their own sections, it’s time for you to get started.

There’s no right or wrong way to do this. Sometimes it helps to begin at the first page and work through the sections consecutively. Other times, it feels right to tackle the key sections – the ones you suspect are going to be hardest to get right or which there’s likely to be most debate about. Or you might want to start with the easiest bits, so you feel you’re making progress. That can give you a confidence boost.

For each section, take your outline content from step 6 and use it to write subheadings. These are really useful for:

(a) setting out your main messages, so the reader can get the gist of the content without reading all of it, and

(b) breaking the text up visually, so it’s easier and more inviting to read.

Taking our hypothetical example of the markets section, your headings might be:

- A £10 billion market

- New products are increasing demand

- Competition is strong but steady

- New markets are opening up

Then use the information you got from your contributors to fill in the content under each heading. You can start by jotting notes, until you’ve got your argument straight.

As you’re doing this, test the content against the following criteria:

- Does my audience want to know this?

- Is it material to their understanding of the subject?

- Is it consistent with our key messages?

- Is it consistent with what we’re saying elsewhere in the report?

- Do I need to cross reference this to somewhere else in the report, where there’s more information?

Then check through your interview notes or questionnaires, to make sure you haven’t missed anything vital. It’s likely you’ll have been given more information than you can actually use and it’s easy to lose important nuggets within that wealth of detail.

UK listed companies also need to consider whether the content is fair, balanced and understandable. The rules no longer allow you to put your best spin on a tricky situation.

Once you’re happy you’ve got the right content, turn it into proper sentences and paragraphs. This is the easy bit. Do your best to stick to the word count, accepting that it will need editing later anyway.

10. Read through your draft

Think about the following questions:

- Does this report tell a consistent story throughout?

- Is there unnecessary repetition?

- Can I cut any of this without losing information my readers will want?

- Is the style consistent?

- Does this meet regulatory requirements?

- Have I drawn out the connections between the different sections?

Amend your draft as necessary.

11. Send your material out for review

Some people will need to see the full report but others might just get the sections they’ve contributed to. Ask for specific feedback that you can use to correct the text. You may want to ask them to focus on:

- Factual errors

- Materiality – whether you’ve given a subject too much or too little coverage, relative to its importance

- Understandability – whether the content makes sense

- Repetition – whether you’ve covered the same thing in too many places

- Fairness and balance – whether you’ve been too positive or negative

Set deadlines for when you need feedback. Give your contributors enough time but chase everyone who’s late. Delays getting feedback can kill your timetable.

12. Incorporate feedback

Make sure the style is consistent and that any new material doesn’t contradict what is already there.

13. Reissue and seek further feedback

If things are going well, this should just be fine tuning. If not, take a triage approach. Focus on the key things that aren’t working and make sure you fix them first. You can’t leave your strategy description to the night before your deadline. Worry about the small stuff later.

14. Ask your contributors to sign off the content

Get them to do it in writing. If that means a signature on a printed copy, so be it. At the very least get an email confirmation that they’re happy with it.

Doing this will:

(a) focus their minds on whether you’re really saying the right things, and

(b) give you peace of mind that your content is properly approved.

15. Provide the final copy to your design agency

You’re nearly there. Once you have the typeset copy, check it thoroughly – everything from image captions to content pages need to be right.

Don’t try to do the final proofread yourself, though. When you’ve worked with the copy, you start to see what you think is there, not what actually is. Find a couple of smart and conscientious people in your organisation to proof it, or employ a professional – you’ll be glad you did.

16. Capture the lessons for next time

Once the dust has settled, sit down with your key contributors and your design agency. Figure out what parts of the process worked well and where you can improve next time. There’s no perfect process but you can always make life easier for yourself, so don’t miss the opportunity.