Value Added Tax (VAT) in Bangladesh | Tax Submission in Bangladesh

All goods except those listed in the VAT Act’s First Schedule and all services except those specified in the Second Schedule are taxable goods and services. Originally, a comprehensive list comprising the list of services subject to VAT was the Second Schedule of the VAT Act. The First and Second Schedules now list respectively statutory exemptions to goods and services. The third schedule lists the goods and services subject to additional duties (SD) and their relevant statutory rates.

Rates of Vat in Bangladesh

Most of the countries that implement VAT worldwide operate a single standard VAT rate. Appendix 1 indicates certain countries ‘ VAT rates with the year in which they launched VAT. In regards to Tax Submission in Bangladesh, country’s VAT legislation provides a standard rate of 15 percent for home consumption goods and services in line with best international practice and a zero rate for exports. Under the rule, all taxable goods and services manufactured and sold for sale in the country are subject to VAT at 15%. For all goods and services to be exported and deemed to be exported from the country, a rate of 0 percent applies. In practice, however, there are some other rates that emerged from different methods

Registration of VAT in Bangladesh

All importers, zero-threshold exporters and suppliers (manufacturers, dealers, wholesalers, retailers) of all taxable goods and services with an annual turnover limit of BDT 60 millions (BDT 6 million, equivalent to US$ 80,400) and above are required to be registered under VAT. The VAT law requires a divisional VAT office to issue a certificate of registration within 2 (two) working days of receiving a request.

Businesses below the threshold can opt for voluntary registration of VAT in Bangladesh, in line with international practice. The amount of VAT collected shows that the majority of VAT registered persons are optionally or voluntarily registered.

One of the reasons is that while the threshold has undergone upward revision quite a few times over the past 20 years, those with their existing threshold within voluntary VAT registration could not escape the net once the threshold was increased due to administrative convenience as well as external pressure.

The study of different VAT regimes, particularly those of developing countries, suggests that in a simpler procedure, despite the distortionary effects of the different treatment between undertakings above and below the threshold, many countries tax undertakings differently and at a much lower rate.

This is done primarily because of the administrative and compliance costs, equity and competitive advantages and disadvantages of the economically involved parties. In Bangladesh, this is no exception. Section 8 of the Act provides that undertakings whose annual turnover is below the VAT threshold and for which VAT registration has not been made compulsory are entitled to pay turnover tax @ 3% of declared and approved annual turnover without the possibility of claiming input tax credit. Nevertheless, most of the taxable products listed and a number of items are not eligible for turnover tax as they are required to register VAT.

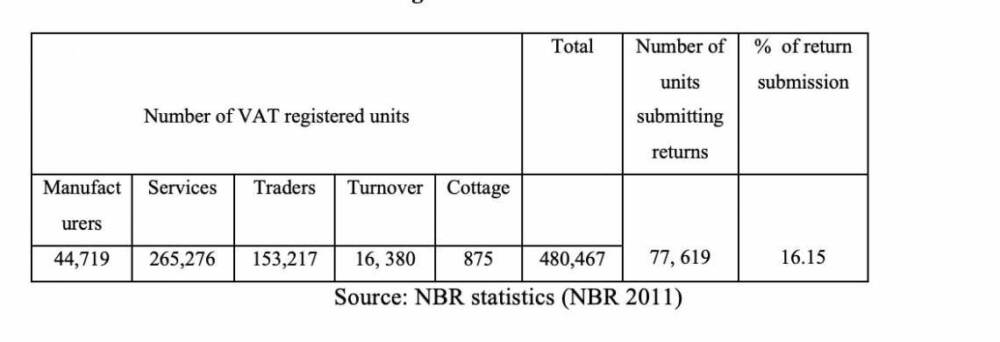

The number of businesses registered under VAT system is 480,467, which is glaringly poor as compared to the number of total businesses in the country. According to the economic census of 2001 and 2003 the total number of businesses in different sectors was 3,674, 971 of which 1,127, 613 were registered with the trade licensing authorities

Vat Filling in Bangladesh | Vat Submission in Bangladesh

Compliance with taxes is ensured by submitting periodic returns. In Bangladesh VAT, a registered person is required to submit a return in a tax period in accordance with section 35 of the VAT Act. Submitted in a prescribed form –(Mushak 19) in duplicate to the local VAT office within 15 days of the following month, VAT returns are normally submitted on a monthly basis, although there are provisions for quarterly and semi-annual returns for certain companies. Compliance with taxes is ensured by submitting periodic returns. In Bangladesh VAT, a registered person is required to submit a return in a tax period in accordance with section 35 of the VAT Act. Submitted in a prescribed form –(Mushak 19) in duplicate to the local VAT office within 15 days of the following month, VAT returns are normally submitted on a monthly basis, although there are provisions for quarterly and semi-annual returns for certain companies. The Bangladesh VAT filing scenario shows a huge difference between what’s being taught in the book and what’s being done.

Although Return should be the core of all VAT activities in an ideal VAT system, namely tax liability, input tax credit, drawback, and revenue statistics, VAT returns were not given the importance they deserve in Bangladesh. Return filing rate is very low. According to the latest statistics, out of 480,467 registered VAT-payers, the number of returning units in 2009-2010 was only 77,619, i.e. 16.15% (NBR, 2011).

One of the reasons for weak return filing is that VAT is obtained at sources in the case of firms with more than 70% (estimated) registered individuals, such as construction firm, procurement provider. The lack of a culture of voluntary tax compliance is another reason for the unsatisfactory rate of return submission. Due to the lack of successful compliance, the situation is further compounded.

Until now, there has been no significant VAT system automation in Bangladesh. Although most VAT commissioners have data processing units with the VAT Information Management System (VIMS) computer program in place, returns are not processed systematically.